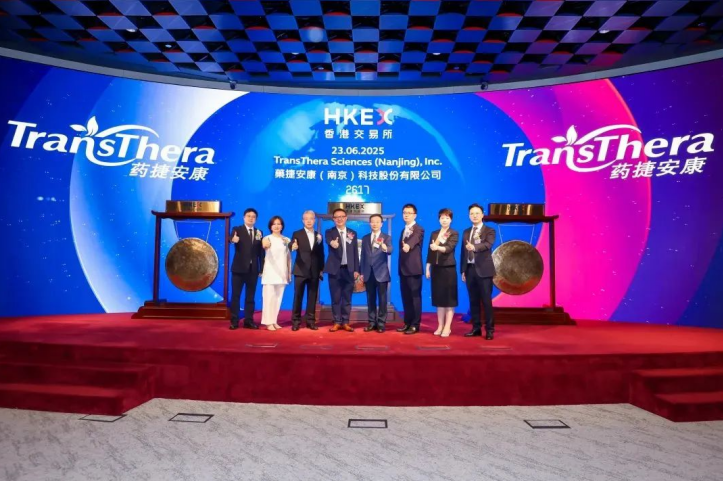

Xichuang Venture Capital's invested enterprise, Yaojie Ankang, has landed on the Hong Kong Stock Exchange

On June 23rd, Xi Venture Capital's invested company Yaojie Ankang (02617. HK) was officially listed on the Hong Kong Stock Exchange, with a price of HKD 13.15 per share and an initial financing of approximately HKD 200 million. As of the first day of trading, Yaojie Ankang's stock price was HKD 23.50 per share, up about 80%, with a total market value of HKD 9.3 billion.

Founded in April 2014, Yaojie Ankang is a biopharmaceutical company focused on discovering and developing innovative small molecule therapies for tumors, inflammations, and cardiovascular metabolic diseases, guided by clinical needs and in the registered clinical stage.

With its fully integrated internal "ACE" method, WuXi AppTec has established a pipeline of 6 clinical stage candidate products and 1 preclinical stage candidate product, and plans to continue expanding. Its core product Tinengotinib is a multi-target kinase inhibitor with the potential to be a "First in Class" in the world. It has shown significant clinical prospects in the treatment of various recurrent or refractory drug-resistant solid tumors and has been approved by the National Medical Products Administration for inclusion in the breakthrough treatment list and has obtained the "orphan drug certification" from the US FDA.

Wuxi Capital Group has long been deeply involved in strategic emerging industries such as biomedicine, relying on its professional investment capabilities to explore and cultivate high growth projects. It provides enterprises with resource docking and value-added services covering the entire life cycle of research and development support, market expansion, etc., and uses capital empowerment to promote the integrated development of technological innovation and industrial innovation.

About wuXi Capital Group<span

Wuxi capital Group is a state-owned venture capital institution that integrates seed, angel, entrepreneurship, equity, mergers and acquisitions, and S funds. The company has established a fund system covering the entire life cycle of enterprises, managing a total fund size of over 270 billion yuan, and providing comprehensive support to enterprises that are in line with their development stages; Focusing on strategic emerging industries such as biomedicine, integrated circuits, dual carbon energy conservation, and artificial intelligence, the management fund has invested in over 1600 companies and participated in the cultivation of more than 110 listed companies such as Longda Corporation, New Clean Energy, and Time Angel.