Xi Venture Capital has won multiple honors in the "2025 China Equity Investment Series Mid Year List" as a business card

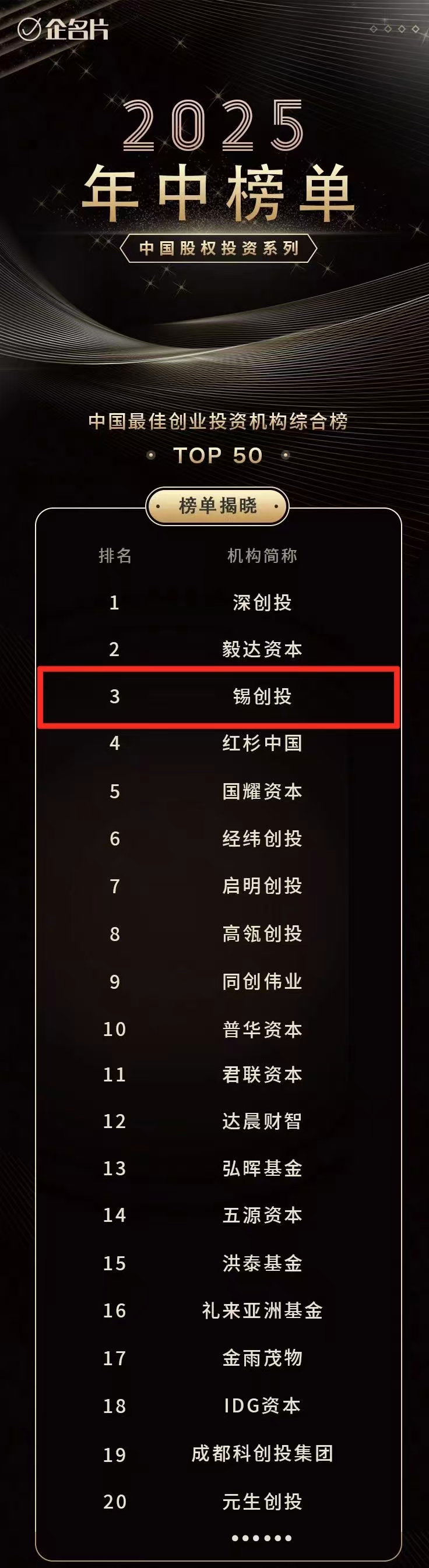

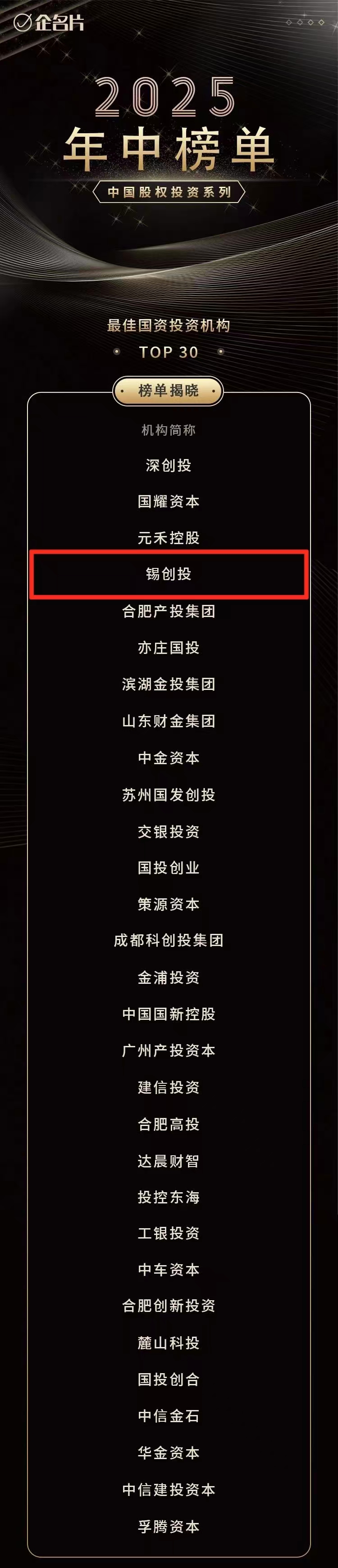

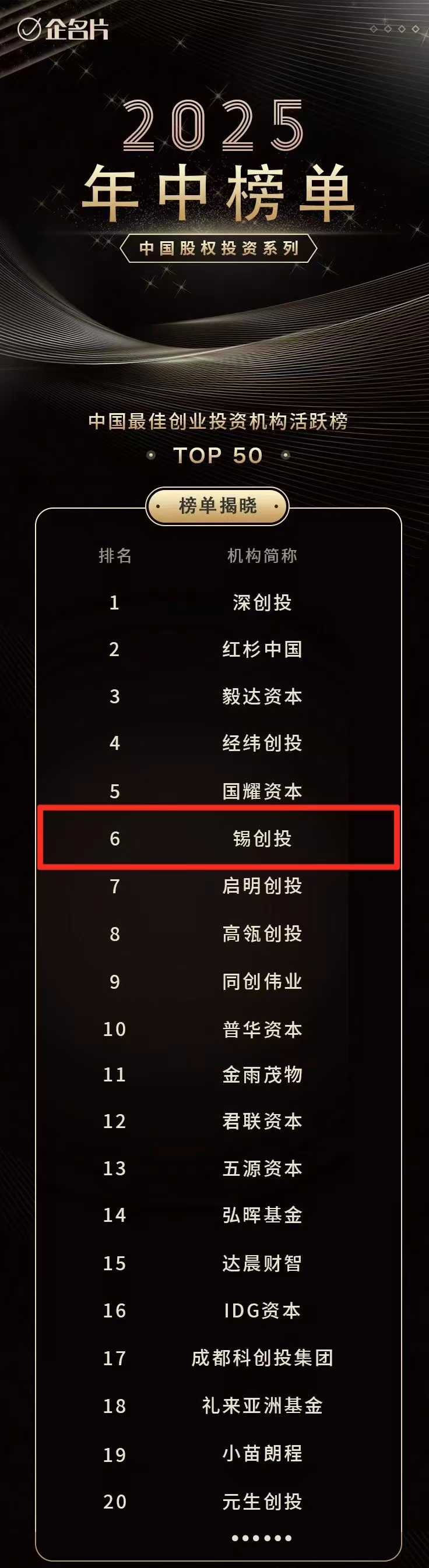

Recently, the "2025 China Equity Investment Series Mid Year Ranking" was officially released. With its professional ability and performance in the field of equity investment, Xicheng Venture Capital has won multiple honors such as the Top 3 Comprehensive List of China's Best Venture Capital Institutions, the Top 4 Best State owned Investment Institutions, and the Top 6 Active List of China's Best Venture Capital Institutions.

It is reported that in order to comprehensively understand and review the situation of China's equity investment and financing market in 2025, Enterprise Business Card is open to all active and excellent institutions in China. Data is collected through various methods such as self registration, desktop research, survey questionnaires, group visits, and telephone interviews, adhering to the principle of data as the first criterion for selection. Based on the performance of the four dimensions of "fundraising, investment, management, and withdrawal", corresponding rankings are selected.

Xi Venture Capital has long focused on strategic emerging industries and future industries such as biomedicine, integrated circuits, dual carbon energy conservation, and artificial intelligence. Adhering to the value investment concept, it deeply cultivates industrial development and professional research in core areas, adheres to the principles of "early investment, small investment, long-term investment, and hard technology investment", and continues to empower innovative enterprises to cross the growth cycle with professional capabilities, accelerating the cultivation and development of new quality productivity.

About Xi Venture Capital

Xi Venture Capital is a state-owned venture capital institution that integrates seed, angel, entrepreneurship, equity, mergers and acquisitions, and S funds. The company has established a fund system covering the entire life cycle of enterprises, managing a total fund size of over 280 billion yuan, and providing comprehensive support to enterprises that are in line with their development stages; Focusing on strategic emerging industries such as biomedicine, integrated circuits, dual carbon energy conservation, and artificial intelligence, the management fund has invested in over 2000 companies and participated in the cultivation of more than 110 listed companies such as Longda Corporation, New Clean Energy, and Time Angel.